In an on-going drive to champion privacy, Apple announced several privacy-related updates that will go into effect after iOS 14. Most notably, Apple have made privacy updates which will limit IDFA’s – Identifier For Advertisers – use for advertisers.

This move has ramifications for consumers, ad platforms, and of course, advertisers.

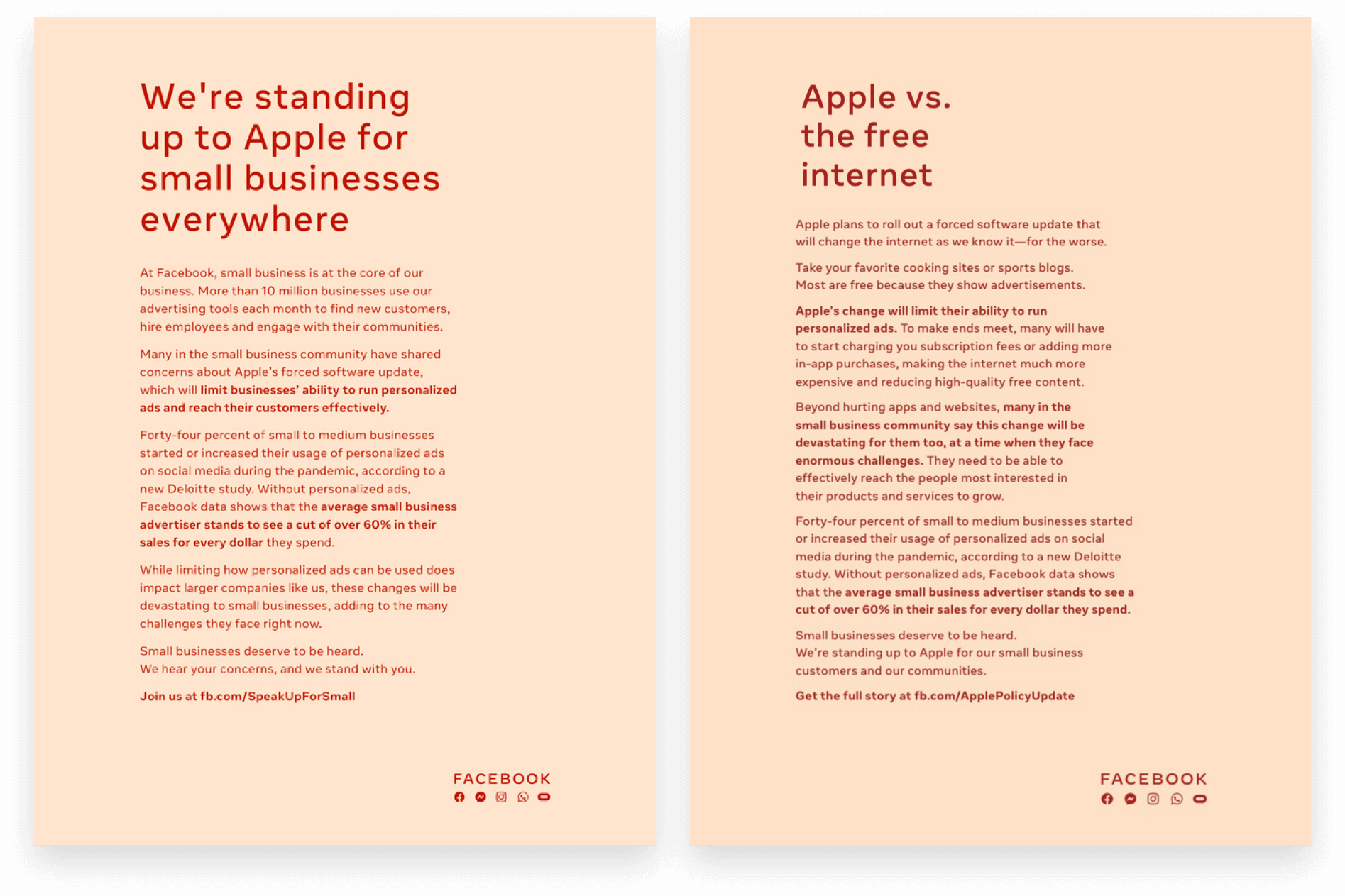

Facebook have responded by going all-out Facebook, taking out full-page ads in the Washington Post and New York Times. They created a website that slammed Apple’s moves as potentially hurtful to small businesses. In an altogether hilariously petty move, Facebook also recently removed the blue verification tick from Apple’s Facebook page.

It’s fair to say that Facebook is taking this pretty badly.

Many advertisers still aren’t aware of the impact that this change could have on their businesses, and nowhere is that more so than DTC eCommerce, which has long seen Facebook Ads as a staple of direct customer acquisition. Historically, IDFA has been an important component of this as it acts as a key signal for social networks and ad companies to track and identify users when targeting iOS users.

We have put together this guide, outlining what the changes are, the anticipated impacts, and longer-term, the winners and losers of this push towards privacy.

Sign up to our free Google Ads email course.

7 days, 7 lessons. Everything from how to structure your Google Smart Shopping campaigns to ad testing, and YouTube ads excellence. Sign up and level up your Google Ads eCommerce game.

What exactly have Apple done within iOS 14 and why?

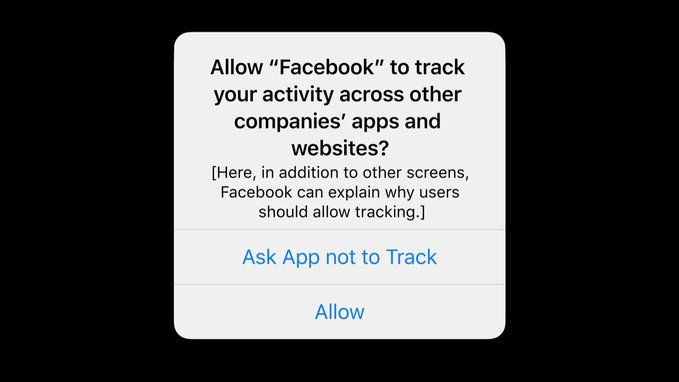

Apple has been alluding to greater control around user privacy for a while, recently announcing that large scale changes would be rolled out in “early 2021” within its iOS 14 update. Whilst it has been quite vague on detail, more information has emerged on what this might look like, with Apple CEO Tim Cook recently tweeting an image of App Tracking Transparency protocol in action – a prompt that informs the user that they are being tracked by an app, in this case Facebook.

Reports from the prominent Apple blog MacRumours seem to suggest that ATT has already started appearing for a few users in the first beta of iOS 14.4. It looks like that each app will have to explicitly ask the user if it can track their activities beyond the use of the app. Previously, no such prompt existed, meaning that publishers and app developers could freely track users without explicitly asking for permission.

How will this update affect my customer acquisition strategy, specifically in regards to Facebook Ads?

So let’s start with what we mean by ‘tracking’. Broadly speaking, we would define this as displaying targeted advertisements in an app based on user data collected from third-party apps and websites. This may also include sharing of device location data or email lists.

This is important to define as it all relates to personalised advertising, or targeting users based on their behaviour or interests, and also how you might report on the actions users take once they engage with your ads – i.e. measurement.

For example, ATT will likely reduce the number of users who actively opt-in to be tracked for personalised advertising. Practically, this might mean that you will find it more difficult to target people based on behavioural factors, such as websites visited, pages viewed, and even videos or content engaged with. That’s because you’ve effectively gone from targeting 100% of people that have exhibited those behaviours to being able to target only those who have explicitly granted the app permission to track them.

That could be a 10% drop-off in targeting and measurement capability. It could be 40%. It could be 70%. No one knows yet, and it’s likely to vary from app to app, publisher to publisher. Due to negative press around privacy and data abuse, Facebook could see much lower opt-in than say, YouTube.

DigiDay reports that when iOS 13 rolled out a similar prompt for geographic tracking, opt-in rates plummeted below 50%. In a post by Dan Levy, Facebook’s VP of Ads & Business Products, he notes that in some tests, advertisers saw a more than 50% drop in revenue, once ad personalisation was removed.

With diminished tracking, Facebook in particular starts to become a less attractive proposition to eCommerce advertisers, who have historically viewed the platform as a key medium for customer acquisition. For years, Facebook’s Pixel has sat on virtually every eCommerce website, quietly tracking every action, from view to purchase. That data was what made Facebook so valuable – it would use that as part of it’s Machine Learning algorithm to find people with similar interests and behaviours to your customers.

However, in one fell swoop, Facebook’s advertising USP is looking vulnerable.

In a post on its Facebook For Developers blog, the ad giant also announced that it will begin to use statistical modeling for certain attribution windows and metrics to account for reduced data availability. In other words, it will guess how people are interacting with your ads, and what actions they take when they do.

That, in itself, is a statement that could fundamentally change the landscape for performance advertisers, who rely on precision to make informed decisions on marketing ROI.

What does this update mean for other customer acquisition platforms, such as Pinterest, TikTok, and YouTube?

Difficult to say what the precise impact may be, but all apps will need to adapt to the new rules. Opt-in rates may vary from app to app, so it’s important that app publishers communicate the benefits that users can expect from tracking.

What steps do I need to take to off-set any negative impact?

Choose up to 8 conversion events

In response to Apple’s announcement, Facebook will introduce Aggregated Event Measurement to support measurement of web events from iOS 14 users once Apple requires the ATT prompt. This, it states, is designed to help advertisers measure campaign performance in a way that is consistent with consumers’ decisions about their data.

In a nutshell, advertisers will be limited to just 8 conversion events per domain. Ad sets optimizing for an event beyond the 8 that are prioritised will be paused. The 8 conversion events per domain will be ranked ‘based on priority’. If multiple events are completed by a user, such as if they ‘add to cart’ and ‘purchase’, only the higher prioritised event will be reported.

How all of this relates to users that do not opt-in remains unclear. What is known, is that advertisers will need to select which events they want to actively track for opted-in users within Events Manager.

Verify your domain

Facebook also recommends that brands verify their domains as a first step, as this will ensure no immediate or future disruption in the ability to configure conversion events.

Dynamic Product Ads

Facebook anticipates little-to-no impact for eCommerce advertisers running DPA across broad audiences. However, for retargeting, the impact is likely to be significant, with both performance and audience size expected to decrease.

A key consideration here is to look at which events you want to focus on as Facebook will limit pixel events to 1 per catalog.

Diversify your customer acquisition, today

There are brands out there that have built their businesses off the back of Facebook, and are still very much reliant on it for customer acquisition. We call these brands, DTC 1.0 – brands which put considerable emphasis on Facebook and Instagram to scale their following and who are still heavily dependent on these channels to drive the bulk of their traffic.

Replicating the success of these brands may become harder than ever, and in some cases, nearly impossible.

Google Ads must be a core component of any DTC eCommerce customer acquisition mix, as it provides a gateway to search, Shopping, display, and YouTube under one ecosystem. Similarly, platforms like Pinterest can no longer be ignored for demand generation, even if targeting and measurement capability may likewise be affected by ATT and the iOS 14 update.

Bottom line – diversify your customer acquisition efforts across three or four core platforms, and you’ll be in a much more robust position than the majority of your industry peers.

Why is Facebook Shops so important going forward?

One of Facebook’s key challenges lies in its need to diversify. The pandemic ruthlessly exposed the vulnerabilities in relying on ad revenue to fuel growth, especially so for Facebook, which generates nearly all of its revenue from advertising. When COVID-19 hit, many advertisers paused their campaigns, and Facebook’s revenue dropped significantly. For Facebook, in-platform eCommerce is one way to diversify, particularly amongst small businesses which may not have an existing website.

Facebook has been experimenting with eCommerce on Instagram for a while, having rolled out its Instagram Checkout feature last year, aiming to provide a seamless checkout experience within the app. Building on that, it opened Facebook Shops to effectively expand upon Checkout capabilities. All businesses need to do is upload their product catalog to the platform – no coding or design skills required.

With this move, Facebook has Amazon firmly in their cross-hairs. The eCommerce giant has been steadily building out its advertising platform over the last few years, in order to become more of a discovery channel for its merchants. Meanwhile, Facebook has been relentlessly exploring ways to leverage its users and brands to execute on its desire to drive transactions within its own platform.

That goal is no more important than ever. If Facebook is able to scale Shops, it will have an end-to-end solution for eCommerce brands, making revenue through both robust ad sales and a % cut of transactions.

It will effectively have the keys to a prized business model, one where it’s no longer as vulnerable to upstream policy shifts by the likes of Apple.

However, Shops has only just been launched, and early reports indicate that it has a long way to go to achieve Facebook’s ambition.

Who are the likely winners and losers of this going forward?

As with any material change in the advertising landscape, there are likely to be several winners and losers.

The Winners

Consumers

Strictly speaking, any push to protect user privacy should be seen as an unequivocal victory for the consumer. By tracking users as they engage with 3rd-party apps and websites, it could be argued that irresponsible advertisers could effectively inundate consumers with intrusive ads, especially around sensitive areas that may cause discomfort.

This change mitigates that risk greatly. Consumers will become more empowered to choose who exactly they share their data with, and for what purpose.

That being said, by reducing the ability to tailor ads to a desired audience, the consumer could effectively suffer in the long-term, as they won’t be exposed to as many relevant ads. This may even become an area of frustration once the dust settles.

Amazon

Facebook’s loss is very much Amazon’s gain. Amazon is about to get a lot more attractive for SMEs, given that the purchase events that advertisers value so much happen on its platform, and not theirs.

This is important as Amazon effectively owns the data from view to purchase. It’s simply nowhere near as vulnerable as Facebook when it comes to 3rd-party tracking and data sharing.

Premium DTC brands may be somewhat reticent to explore Amazon as a sales channel, due to positioning concerns. However, presence on Amazon is no longer simply a recommendation for acquisition-orientated eCommerce brands, it’s now crucial to growth. The more you resist now, the further behind the curve you’ll be when it becomes a primary source of acquisition for your competitors.

1st-Party Data & Email

Your 1st-party data is likely to become even more valuable, as this will be largely unaffected by ATT, at least based on what we know so far. Building a robust database will take on even more importance in 2021, so look to leverage existing tools and ad formats to help drive this further.

Email will also likely become more prominent as a last-click customer acquisition channel, so investing in data collation, segmentation, and creative here will be especially important.

Shopify

As part of the development of Facebook Shops, Facebook partnered with Shopify to help build a fast and seamless in-app shopping experience.

Given that building a holistic discovery-to-purchase shopping experience is now a strategic priority, the integration between these two companies is likely to become more central to Facebook’s growth than originally anticipated. So much so, we may even see an acquisition take place in 2021.

Apple

Whatever you think of the move, one thing is for sure – Apple is winning the PR war with Facebook, and it ain’t even close.

In one move, Apple has significantly weakened several indirect competitors at once, while positioning itself as unequivocally pro-consumer. It’s the ultimate power play.

Google bought Android, the other dominant operating system, in 2005. At the time, it was seen as a way to quickly and cheaply get into the mobile device ecosystem. However, it has turned out to be much more important than that, and quite possibly the most important acquisition that the tech giant has ever made. We’ll likely see more focus on the Android consumer amongst advertisers, safe in the knowledge that they have greater control and visibility over who sees their ads.

We’ll also see a shift in budgets, from Facebook to Google Shopping and YouTube in particular.

Although YouTube, as an app-based platform, is equally susceptible to data loss, we’re hypothesising that the opt-in to YouTuibe would be far higher than Facebook, as ad relevancy is actually quite important to the user experience. In being exposed to random ads, especially within pre-roll, the user actually loses out and is likely to be conscious of this when making opt-in decisions.

The issue of trust within data sharing is also important – YouTube may score higher than Facebook here.

The Losers

Ad platforms in general, but mainly Facebook

Facebook had a lot of time to negate the impact of this change. It perhaps could and should have seen earlier that a policy change upstream would have had a potentially crippling effect on its own operations. It failed there.

It could have made a more concerted effort earlier on to build out an intuitive in-app purchase experience, thus mitigating the influence of upstream stakeholders. So far, it’s failed here too.

It could have done more to fight the perception of being anti-privacy, and therefore anti-consumer. It’s failed hard here, with the recent press ads doing nothing to reverse this perception.

Its moat – the power of its pixel – is likely to be much less defensible going forward, meaning that it needs to find a way to keep users on its own platform when they purchase products, instead of doing so on retailer websites.

I’m not 100% convinced that it will achieve this in the short-term, and predict that 2021 will be the year that performance advertisers will begin to lose confidence in the platform.

Looking up the food chain, investors will become increasingly anxious as falling CPMs will mean that sooner or later, its share price will begin to decline over a prolonged period. That’s not just something that should concern Facebook, that’s an issue that should trouble any platform that doesn’t have end-to-end visibility of the purchase journey – i.e. Pinterest, TikTok, SnapChat.

Facebook’s PR department

The full-page ads, positioning Facebook as some kind of small business messiah were a transparent act of desperation. The Electronic Frontier Foundation, a non-profit organisation that champions civil liberties within the digital world, even called Facebook’s PR response “laughable”.

The reality is that SMEs, particularly those within eCommerce, can take their ad dollars to any number of ad platforms – yes, there will be an ATT impact wherever you choose to invest your marketing budget, but it’s manageable. For those that relied so long on Facebook as the primary source of customer acquisition, this will surely represent the most compelling reminder that you shouldn’t put all of your advertising eggs into a single ecosystem.

While Facebook has tried to paint Apple’s position on privacy as a negative, in reality it’s anything but. And the latest all-out press offensive could actually be doing more harm than good when it comes to its reputation as a steward of users’ data.

How can I keep updated on how this plays out?

One thing’s for sure, 2021 will be very interesting. We expect this year to be one of the most important, landscape-defining periods for the advertising world.

You can stay-up-to-date with how all of this unfolds, the impact, and strategies you can adopt for maneuvering the disruption by signing up to our monthly DTC eCommerce newsletter, The Navigator.